The Journey of CBD: From Fringe to Mainstream

(and What Comes Next)

-

By Jeremy Amos

Published: Monday, Sept 15, 2025

The 30-Year Blink: How CBD Went Mainstream

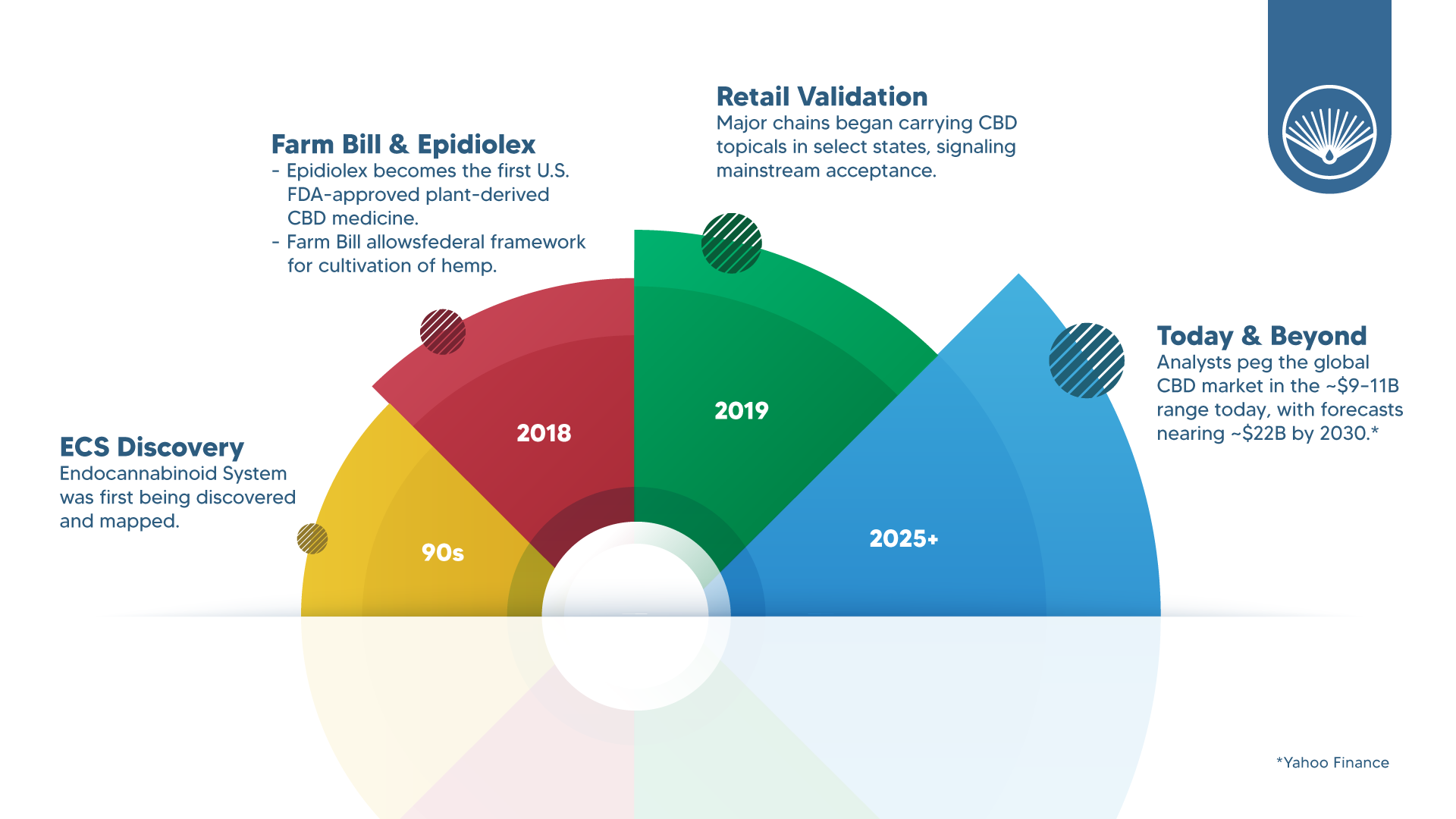

Thirty years ago, the endocannabinoid system (ECS) was just being mapped; today, CBD is a global category with billions in annual sales and serious scientific attention. In 2018, the U.S. approved the first plant-derived CBD prescription drug (Epidiolex), and the Farm Bill legalized hemp (≤0.3% Δ9-THC) nationwide—opening the door to regulated cultivation and a modern supply chain. (Congress.gov)

The market is still evolving—fast. Depending on methodology, researchers estimate the global CBD market in the high single-digit billions today with double-digit CAGR this decade. Exact numbers vary, but the direction is unmistakable: sustained growth as quality, consistency, and evidence improve. (Yahoo Finance)

Yesterday: The Breakthroughs That Set the Stage

1990s—The ECS comes into focus. Scientists identified cannabinoid receptors (CB1, CB2) and endogenous ligands like anandamide—revealing why cannabinoids interact so broadly with human physiology. (Oxford Academic)

2018—Clinical and legal tipping points.

- FDA approval: Epidiolex becomes the first U.S. FDA-approved plant-derived CBD medicine (for rare epilepsies). (PMC PubMed)

- Hemp legalization: The Agriculture Improvement Act of 2018 (Farm Bill) removes hemp (≤0.3% Δ9-THC) from the Controlled Substances Act and establishes a federal framework for cultivation. (Congress.gov)

2019—Retail validation. Major chains began carrying CBD topicals in select states, signaling mainstream acceptance of non-ingestible formats. (Bloomberg)

Takeaway: Yesterday delivered the scaffolding—biology, regulation, and retail adoption—that made today possible.

Today: What the CBD Landscape Really Looks Like

1) Market reality (2025 snapshot).

Analysts peg the global CBD market in the ~$9–11B range today (depending on scope), with forecasts in the ~$22B ballpark by 2030; North America leads by a wide margin, with Europe and APAC accelerating as rules clarify. Methodologies differ, so treat any single figure as directional, not gospel. (Yahoo Finance)

2) Regulatory uncertainty (still).

The FDA has stated current food/supplement pathways aren’t appropriate for CBD and asked Congress for a new framework. That’s slowed innovation in ingestibles and pushed responsible brands to over-invest in testing, labeling, and quality systems. Meanwhile, states have created a patchwork of rules—especially around intoxicating hemp-derived cannabinoids (e.g., Δ8, Δ10), which Congress is actively debating in 2025 bills. (Reuters)

3) Quality and labeling.

Early-market studies and FDA warning letters highlighted mislabeling and contamination risks among some CBD products—one reason certifications and full-panel testing have become table stakes for serious brands. (Congress.gov)

4) What the research is showing.

- Established: Prescription CBD (Epidiolex) is effective for specific epilepsies. (PMC PubMed)

- Emerging: For common consumer goals (sleep, stress, recovery), evidence is promising while more robust, longer-duration trials are still needed. Leading reviews note small-to-moderate benefits in subsets of patients and emphasize dosing/quality control. (Springer Nature)

Takeaway: Today rewards transparency—on sourcing, testing, and claims—and a science-first posture that matches products to the strongest evidence available.

Tomorrow: Where CBD (and Cannabinoids) Are Going

1) Minor cannabinoids, major potential. Interest is rising in CBG, CBN, THCV, CBC and non-intoxicating blends targeting more precise outcomes. Expect tighter specifications, label standardization, and richer data on entourage effects. (Regulators will scrutinize intoxicating hemp derivatives separately.) (Reuters)

2) Format innovation. Beyond oils and gummies, think RTD beverages, EasySnaps, stick packs, and unit-dose formats that improve convenience and compliance—paired with QR-coded COAs and batch-level transparency.

3) Regulatory clarity. A federal CBD framework (once enacted) would likely formalize limits, labeling, and age gating—unlocking mainstream CPG channels. Until then, best-in-class QA and sober claims will differentiate.

4) Evidence maturation. Expect more pragmatic RCTs with wearable endpoints (sleep, HRV) and real-world evidence programs—driving dose-response guidance and clearer “for whom it works” narratives.

What This Means for Brands (and Why OBX Is All-In on Transparency)

Winning brands will:

- Prove it: full-panel testing, QR COAs, and recognized standards (e.g., NSF/ANSI 455, cGMP). (US Food & Drug)

- Say less, mean more: claims that precisely match the evidence.

- Design for trust: clean labels, batch traceability, and third-party certifications (USDA Organic is viable for qualifying hemp inputs/products under updated USDA guidance). (Baystate)

- Think global: plan for regional labeling and cannabinoid rules from day one.

At Open Book Extracts, “true transparency” isn’t a tagline; it’s how we build. From rigorous QA and certifications to pragmatic, science-led formulation, we’re committed to doing CBD the right way—yesterday, today, and tomorrow.

Quick FAQ

- Is CBD “legal”? Hemp-derived CBD is federally legal if it meets the Farm Bill definition and relevant state rules; ingestible pathways are awaiting federal clarity. (Congress.gov)

- What should I look for in a product? COA, cGMP/NSF audits, realistic claims, and transparent sourcing.