CBD by the Numbers: 2025 Market Snapshot

-

By Jeremy Amos

Published: Friday, Sept 19, 2025

The Simplified Story

The U.S. CBD market is forecast around $2.8B in 2025 (non-Rx + Rx combined), with most sales still concentrated in non-pharmaceutical products (think supplements, topicals, gummies, and beverages). (Brightfield Group)

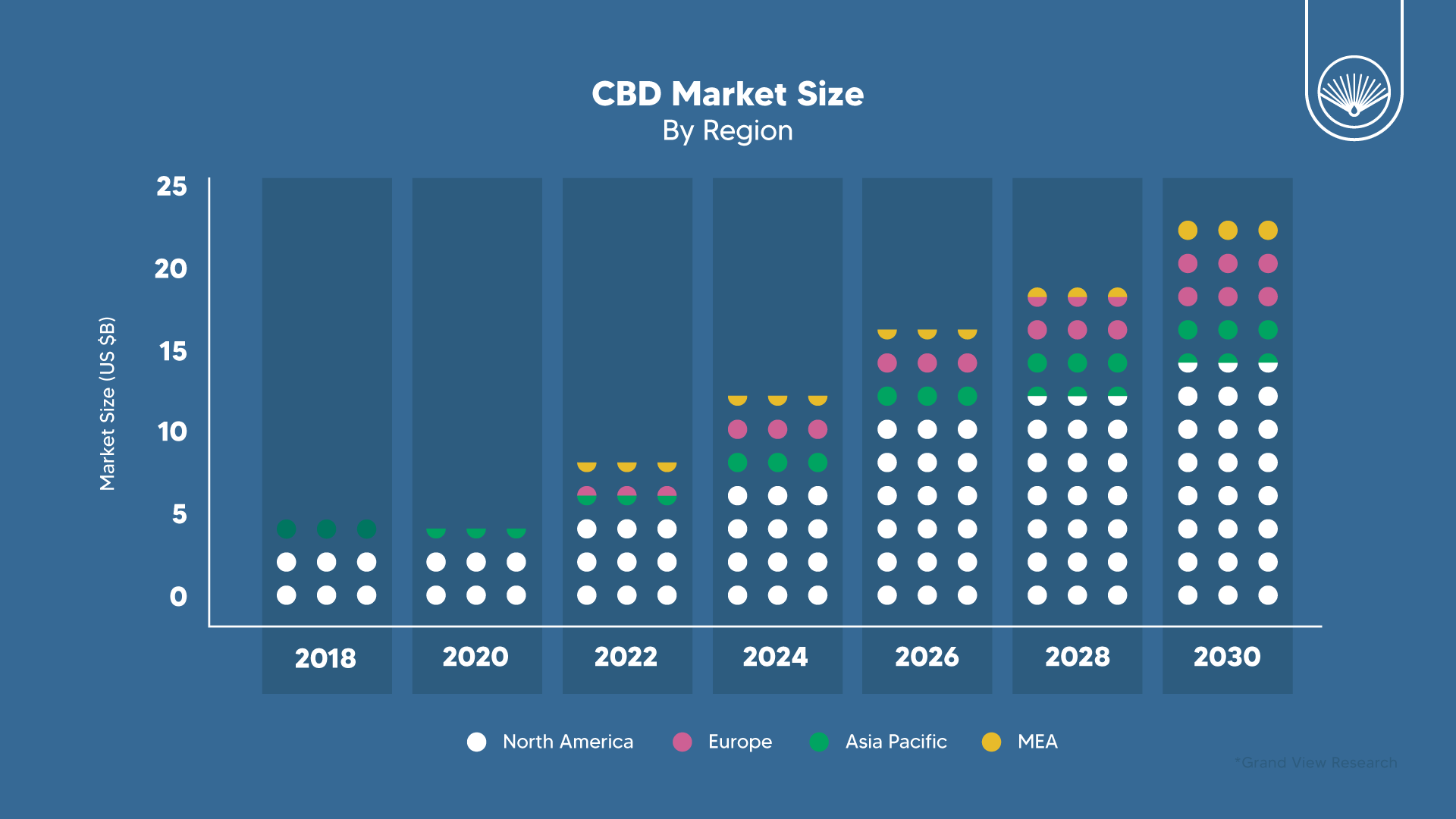

Globally, CBD is already in the high single-digit billions, with forecasts of ~$22B by 2030—though estimates vary widely depending on what’s included. Some firms count only hemp-derived CBD, while others bundle in Rx drugs and gray-market sales. (Yahoo Finance)

North America leads the category today, but Europe and APAC are catching up fast as regulations clarify and consumer adoption rises. (Grand View Research)

How Big Is the Market - Really?

If you ask five research firms, you’ll get five different numbers. The variation comes from:

- Scope differences (Rx vs. non-Rx, hemp-only vs. all cannabinoids).

- Channels counted (online DTC, natural products retail, mass retail, dispensaries).

- Gray market assumptions (intoxicating hemp derivatives like Δ8, Δ9).

Even with the discrepancies, the directional trend is clear: the market continues to expand.

- U.S. 2025: Brightfield estimates ~$2.8B, with non-Rx categories dominating sales.

- Global 2030: Grand View Research projects ~$22B, up from single-digit billions today, representing mid-teens CAGR growth.

Takeaway: Instead of fixating on one number, build plans around ranges. Track category mix (beverages, topicals, pet products) and create optionality in your portfolio—so you can shift into growth categories as regulations and consumer demand evolve.

Where Sales Are Happening

1) North America still accounts for the majority of CBD spend today. Consumers are familiar with the category, distribution channels are more established, and regulations—while imperfect—are more mature than in other regions.

2) Europe is gaining ground. Countries are clarifying rules for ingestible CBD, and retail availability is growing. While regulatory frameworks differ by member state, harmonization is on the horizon.

3) APAC growth is accelerating from a smaller base. Nations like Japan, South Korea, and Australia are cautiously opening to hemp-derived CBD, though formats and marketing claims remain tightly restricted.

4) Latin America & Rest of World remain relatively small today but are viewed as long-term opportunities, especially as agricultural economies explore hemp as a crop.

Takeaway: America still reigns supreme, but other regions are starting to catch up. It's time to start thinking globally.

Regulation: The Biggest Wild Card

The single greatest factor influencing CBD’s future isn’t consumer demand—it’s regulation.

- FDA stance (U.S.): The agency has said current food and supplement pathways aren’t appropriate for CBD and has asked Congress to create a new framework. This uncertainty has slowed broad CPG adoption, especially for ingestibles. (AP News)

- Hemp derivatives: Lawmakers are actively considering 2025 measures that could restrict intoxicating hemp derivatives (like Δ8, Δ10). Meanwhile, states continue to maintain a patchwork of differing rules, forcing brands to operate with hyper-localized compliance strategies. (Reuters)

Until federal clarity arrives, expect headlines, legal debates, and compliance work to dominate.

Evidence: Matching Products to Proof

Science remains a mixed bag—but progress is happening.

- Clear-cut: Prescription CBD (Epidiolex) is proven effective for specific epilepsies. (PMC)

- Evolving: For sleep, stress, inflammation, and recovery, evidence is promising but inconsistent. Some studies show small-to-moderate benefits in certain populations, but results vary by dose, quality, and duration. (Oxford Academic)

Lesson for brands: Don’t over-promise. Instead, over-deliver on quality assurance (QA) and transparency.

What Smart Brands Are Doing in 2025

The winning playbook looks like this:

- Own transparency. QR-linked COAs, batch-level data, and recognized audits (NSF/ANSI 455, cGMP). (NSF)

- Narrow claims. Align product messaging with the strongest evidence—and avoid drug claims. (AP News)

- Format agility. Develop convenient formats (unit-dose sticks, RTDs, gummies) that fit into consumer routines.

- Retail channel fit. Match product types to what each channel can responsibly carry under today’s patchwork of rules.

At Open Book Extracts, we call this the “prove it” mindset:

- Certifications that mean something.

- Labels that match what’s in the bottle.

- Formulations that respect the science.

That’s how CBD grows up as a category—and how trust is built for the long term.